Price Pressures Remain Stubbornly High

+6.3%

excluding

food and

energy

+6.3%

excluding

food and

energy

+6.3%

excluding

food and

energy

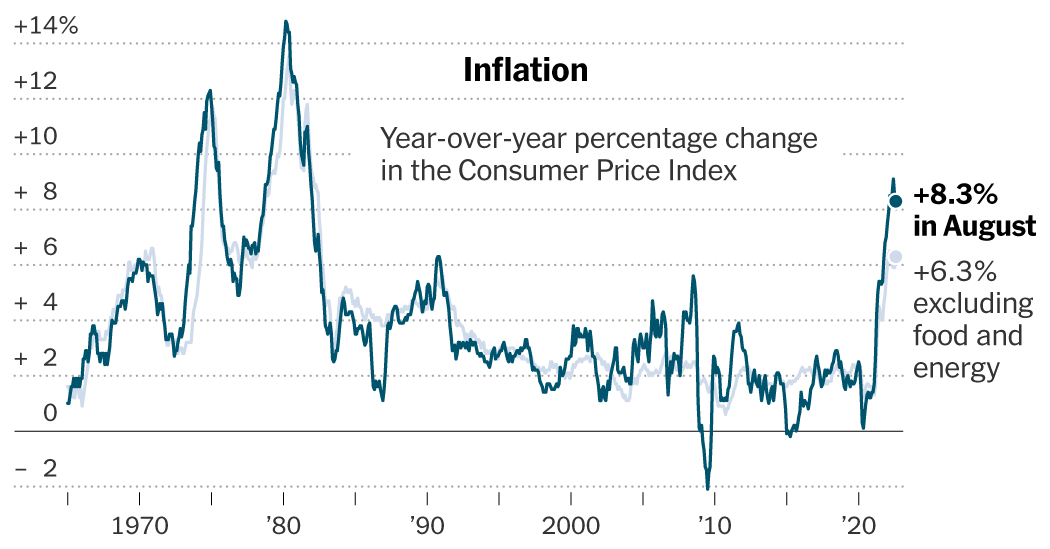

Inflation remained uncomfortably rapid in August despite a decline in gas costs as prices continued to soar across a broad array of other goods and services, evidence that the sustainable slowdown the Federal Reserve and White House have been hoping for remains elusive.

Prices rose 8.3 percent from a year earlier compared to 8.5 percent in July, a fresh Consumer Price Index report released Tuesday showed, a still-rapid pace of increase and not as much of a moderation as economists had expected. The disappointing data came even as falling gas prices pulled inflation lower, with rapidly rising costs for rent, health care, restaurant meals and goods such as furniture offsetting the relief consumers were feeling at the fuel pump.

Compounding the bad news, a core index that strips out gas and food to get a sense of underlying inflation trends accelerated by more than was expected.

For policymakers at the Federal Reserve, who have been raising interest rates to slow the economy and try to tame recent rapid inflation, the report was a fresh sign that price increases have yet to come back under control — and that continued aggressive action may be needed to wrestle them lower.

Economists said that the Consumer Price Index data cemented the case for a third straight, unusually large three-quarter percentage point Fed rate increase at the central bank’s meeting next week, and stocks swooned as investors began to speculate that officials could opt for an even more drastic full percentage point adjustment.

“Inflation remains hot, financial conditions have seen some improvement and the labor markets are humming along,” Neil Dutta, head of U.S. economics at Renaissance Macro, wrote in a research note following the release. “If the goal is to slow things down and create some pain, the Fed is failing by its own standard.”

The Fed closely watches the core inflation gauge, making its rebound in August a point of particular concern. After cutting out food and fuel, consumer prices climbed by 6.3 percent in the year through last month, up from 5.9 percent in July and more than the 6.1 percent economists had projected.

Even looking at overall inflation, the report’s details offered plenty to worry about.

Two products that have been major drivers of inflation over the past year — gas and used cars — are now posting outright price cuts. But other goods and services are picking up in price so much that it is more than offsetting those declines. Prices climbed by 0.1 percent over the course of the past month amid rapid price increases for a broad array of products and services, including food away from home, new cars, dental care and vehicle repair.

The upshot is that inflation has plenty of underlying momentum.

That is likely to keep the Fed firmly in inflation-fighting mode. Central bankers are waiting for a sustained slowdown in price increases to convince them that their policies are working to cool demand and nudge the economy back toward a healthy environment in which inflation is slow, steady and barely noticeable. Until that happens, officials have pledged to keep raising interest rates, moves that can slow borrowing, constrain consumer demand and tamp down hiring and wage growth.

“Inflation is far too high, and it is too soon to say whether inflation is moving meaningfully and persistently downward,” Christopher Waller, a Fed governor, said in a speech last week. “This is a fight we cannot, and will not, walk away from.”